Even when you hire some of the most experienced journalists, there will always be topics that are difficult for them to grasp. Profitability is one of those topics.

When I see journalists conveying that profits are the most important component of any startup, I metaphorically (and sometimes literally) shake my head. Both journalists and entrepreneurs have this mindset that profits are at the top of the startup lists. Don’t get me wrong, profits ARE important. They keep the businesses running. However, so does growth.

Profits and growth have always had a touchy relationship. In order to grow, businesses need a certain amount of financial resources. These resources are needed to cover costs that might not show value for 6 months-year.

For example, if you hire a strategy team of five for $80,000/year each, then you’ll need an extra ~$35,000 per month in order to pay them. Even with an experienced strategy team, deals might not close for up to 6 months.

If you hire 6 sales reps in January at $120,000 / year salary then you’ve taken on an extra $60,000 per month in costs yet these sales people might not close new business for 4-6 months.

Even though this information might seem pretty simple, even the most experienced entrepreneurs tend to forget about it when thinking about profits.

Growing your company is a goal to keep at the top of your list, but you need to remember that hiring more isn’t always the best option. Keep in mind how they’re going to help your company. Will they end up slowing down your revenue? Or does your company have access to funds that will cover temporary loss?

Management Summary:

The majority of companies (98+%) in the world are focused on profits, as they should be. When your company is focused on profits, you don’t have to rely as much on others for funds.

- Having leverage when you’re trying to raise funds IS possible. (There are investors that appreciate how you can profitably run a business without trying to expand into a large one.)

- Exit opportunities increase. Acquirers (like Google and Facebook) are interested in buying companies that will essentially bring more money to their company. If your company isn’t profitable, they’re not going to be interested. Their goal is to earn profits quickly from their acqui-hire so their acquisition price will be paid off and they can continue collecting.

- Focusing on profits will keep your company thriving, even in hard times.

You shouldn’t be focused on profits if you:

- Have opportunities to create businesses of a scalable size.

- Have investors that are looking to build scalable buisnesses.

If you have an awesome idea, others will notice and try to compete with you. If you’re in the lead, you need to find investors and raise capital ASAP. If you don’t, your idea will be in the hands of someone else’s success.

The Specifics

This isn’t the first time I’ve had this conversation. I’ve come across entrepreneurs of all types, but the ones worth mentioning in this instance, are the newer ones that have reached annual revenues of ~$1 million.

As a new entrepreneur, this number sounds so promising and exciting (which it is!), but deciding to keep your costs low in order to finally hit profitability, might not be the right choice. Of course you want to cut strings with investors, but be patient.

If you’re looking to run a smaller business, put your company on the market within a few years, or attempt to raise VC, then by all means, as you were.

If you’re looking to grow your company, raise VC, but maintain some leverage, be careful. Investors of startups tend to care more about growth rather than profits. I completely understand wanting to be in control of your company, but be cautious that it doesn’t hurt your growth.

If a VC were to see that your company raised $4 million and is now earning $2 million in revenue a few years later, they wouldn’t be as impressed as you’d think.

It would be different if your customer growth expanded immensely (without focusing on revenue), you spent those few years perfecting a stellar, new piece of technology, etc. However, if you were simply trying to show that you could earn a profit, you might want to find other resources to help your company grow.

Understanding Profits

Before going into heavier details, let me go over a few of the basics:

Revenue – Cost of Goods Sold (COGS) = Gross Profit (also called Gross Margin or sometimes “Net Revenue”) – Operating Costs = Profit

When looking at an income statement, start by focusing on the revenue line. Revenue growth is something that matters to everyone trying to understand the performance of their company. When journalists inquire about public stocks, I make sure to tell them if two companies both had $200 million in profits, that doesn’t mean their futures are similar. The first company’s growth in revenue might average around 50% per year, where the second company’s might average around 5%.

If both companies had the same net profit margins, the second company would actually be going further than the first.

Even though evaluating stocks by P/E ratios is typically easier, you also need to use other metrics such as PEG. Both metrics are pretty simple compared to some other financial tools in existence.

Investors Look for Growth

When determining the value of a company, you need to look at the value of all potential cash flows modified to today’s dollar. With dollars constantly losing their value, this will help fast-growing companies keep an eye on their future profits.

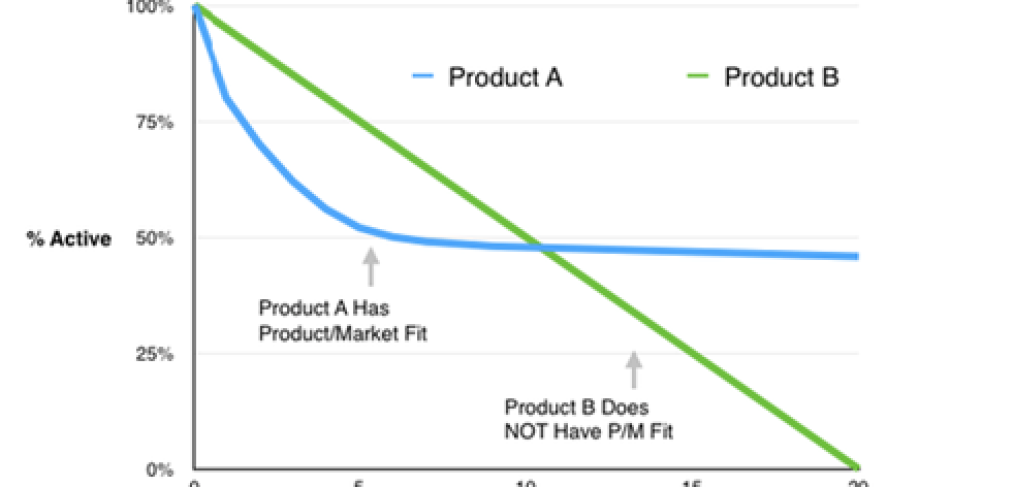

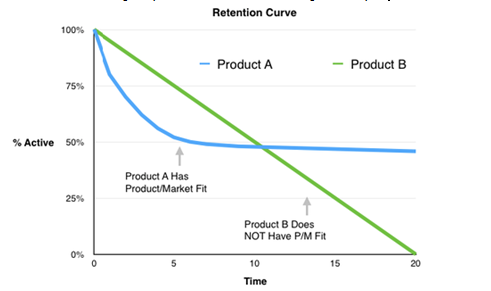

When you’re evaluating a company, you’re going to want to evaluate growth instead of earnings. Earnings alone won’t give you an idea of which company is more successful. Also, when you’re evaluating especially new companies, sometimes you should focus on customer growth instead of revenue.

Where is Your Revenue Coming From?

When I’m evaluating companies that have already established some revenue, I’m going to focus heavily on the revenue line. What does this revenue consist of? Is it based off of one single product or multiple? Who is the revenue coming from, many customers or just a few?

Revenue concentration is something to remember. Your company isn’t growing if a select customers are keeping your business running. If your revenue is concentrated on those select few people, it’s at risk and could potentially decline.

You should also try to figure out the how you’re pricing a product, how competitors are pricing theirs, and any expectations for pricing in the future. Fast-growing companies are often destroyed due to lowering prices in order to compete with others selling a similar product.

Revenue Isn’t Enough

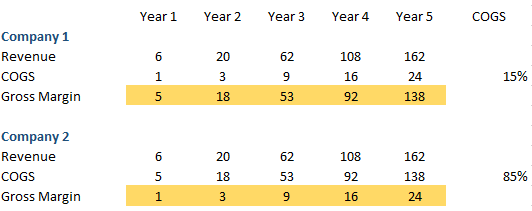

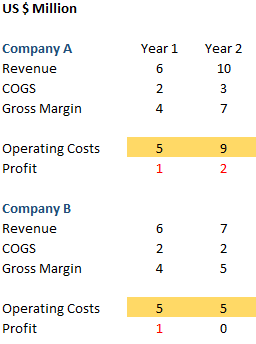

Looking at the revenue in dollar terms isn’t going to be enough. In the graph below, you’ll see that even though both companies garner the same revenue each year, the first company’s gross margins are higher because the COGS are lower.

COGS show how much each sale costs your company. If you sell products through a website like Amazon that charges you 30% of each sale, your COGS will be 30% of revenue.

The example above is not as uncommon as you may think. Company 1 is an example of one that directly sells their products off of their website or through a sales team. The second company is an example of one that has to pay a publisher 85% of their revenue for running ads on their website.

This example can also be one of a travel website that gets paid in rewards for selling airline tickets. Companies strive to have higher numbers in their revenue, even though it can be misleading. For example, if an airline website sells $300 million of Swiss Air tickets, that won’t go directly to them. They’ll get paid a fraction of that from booking fees.

eCommerce websites experience something similar. When an eCommerce website sells products, they have to give a higher percentage of those sales to the manufacturers. The actual gross margins of these eCommerce sites can range anywhere from 15-40%.

Don’t All Companies Strive to be Profitable?

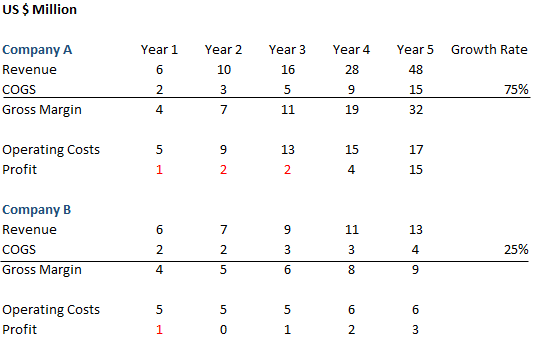

No. Let’s take a look at the following companies, which both have 66% gross margins.

No. Let’s take a look at the following companies, which both have 66% gross margins.

Both of these companies look the same after a year. Both companies look the exact same after one year. They increased seed money but lost around $1 million within the first year.

There’s nothing wrong with your gross margins equaling 66%, but the sales aren’t stellar enough to fund their team (marketing, management, strategy, etc.) When it comes to internet startups, a portion as large as 80% of costs will go towards their team.

How do you know which company is better off?

You can’t. Journalists might state that Company A isn’t profitable. However, that company spent $5 million in VC towards growth. The money wasn’t used carelessly, but was used to fund a larger team in order to launch a second product line. The tech, marketing, and business development team were hired to work on launching those products in order to expand their company.

If there was a need for the products they produced, the investment would be worthwhile.

Take a look at years 1-5 for both of the companies.

While Company B looked frugal at first, Company A’s investment in their team resulted in a higher growth rate. At the end of 5 years, Company A garnered $14 million in profits while Company B only made $5 million.

Currently, Company A is garnering around $47 million in revenue/year where Company B is only earning around $12 million/year. As you can see, growth DOES matter.

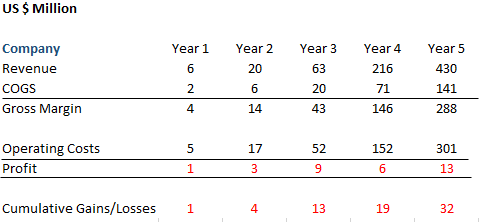

Let’s take a look at an even more intense situation.

The example of the company above must have raised anywhere from $35-50 million in VC to fund those types of operations. Even though that money would’ve been raised in 2-3 tranches, was this a naïve decision?

It depends. If the growth is as substanstial here as it was in Company A (mentioned earlier), then they would’ve been insane not to increase the VC.

You’re able to increase profits by avoiding investing today’s dollar in tomorrow’s growth.

Journalists that slam Amazon for being unprofitable need to understand this:

Since Amazon is growing at such a fast pace, it makes sense that they’re taking today’s profits and investing them in the company’s growth. Companies that aren’t growing as fast should instead return their profits to shareholders.

In Conclusion: Profitability vs. Being Cashflow Positive

Heading back to the basics, I have to say that investors care more about cash flows than they do about income statements.

For those that have just learned the difference between income statements and cash flows, being profitable doesn’t mean you’re being cash flow positive.

It’s possible to lose out on money while you’re being profitable, even if you thought being “profitable” meant making money.

The design of income statements rely on accounting standards, which are designed to “match revenues and costs in the period for which they should be attributed.”

Examples:

- A specific ad network may sell $300,000 in ads. Then, the publisher of the ads will need to be paid within 14 days. The person who bought the ad doesn’t have to pay the network for 60 days.

Even though the person that bought the ad might seem profitable on their income statement, they had to pay $300,000 that they don’t have yet, which results in negative cash flow.

- Let’s say that I sold a $1.5 million contract for two years. Even though I’m booking around $63,000 on my income statement, the customer is paying quarterly. This means during the first few months of every quarter, revenue is showing on my income statement that I haven’t received yet.