Behavioral economics play a huge role in the business and marketing world. Heuristics, framing and market inefficiencies are all extremely relevant – even today. Perhaps most interesting is the idea that our personal biases can help influence decisions and actions in our lives. This concept is called loss aversion.

Some may argue that the concept single-handedly decides how successful a business is. That is because most people tend to work much harder to avoid losses than they do to achieve personal gains. Even when losses are much fewer than gains, people still do their best to avoid them.

By keeping this concept in mind, you can ultimately influence the decisions your customers make and so much more. Starbucks and their paper cup dilemma is a perfect example of this.

Behavioral Economics and Starbucks

The infamous chain café, Starbucks, produces about 4 billion cups per year, regardless of market trends. Not only is that a lot of money going to waste, but it’s also not “green” or good for the environment.

In comparison, that number adds up to about 12 cups for every man, woman and child in the United States – all of them going to waste. Needless to say, Starbucks has a problem with their cups. The issue has escalated to a point where images have surfaced pointing out “branded trash,” which is another way of calling the company wasteful.

The company has recently been working on a way to recycle these cups, or to implement some type of system where they can recoup their losses. Unfortunately, they don’t realize there’s a great way to do this – and they already have a system in place.

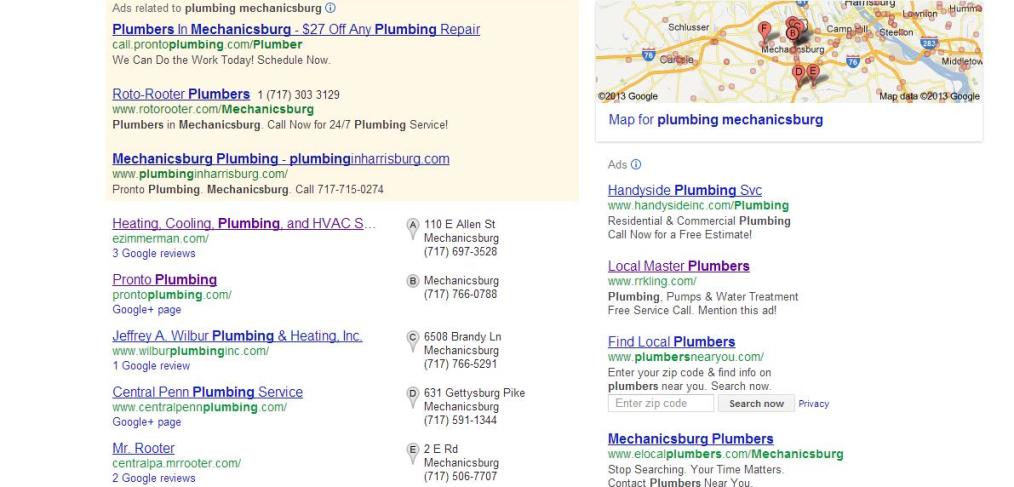

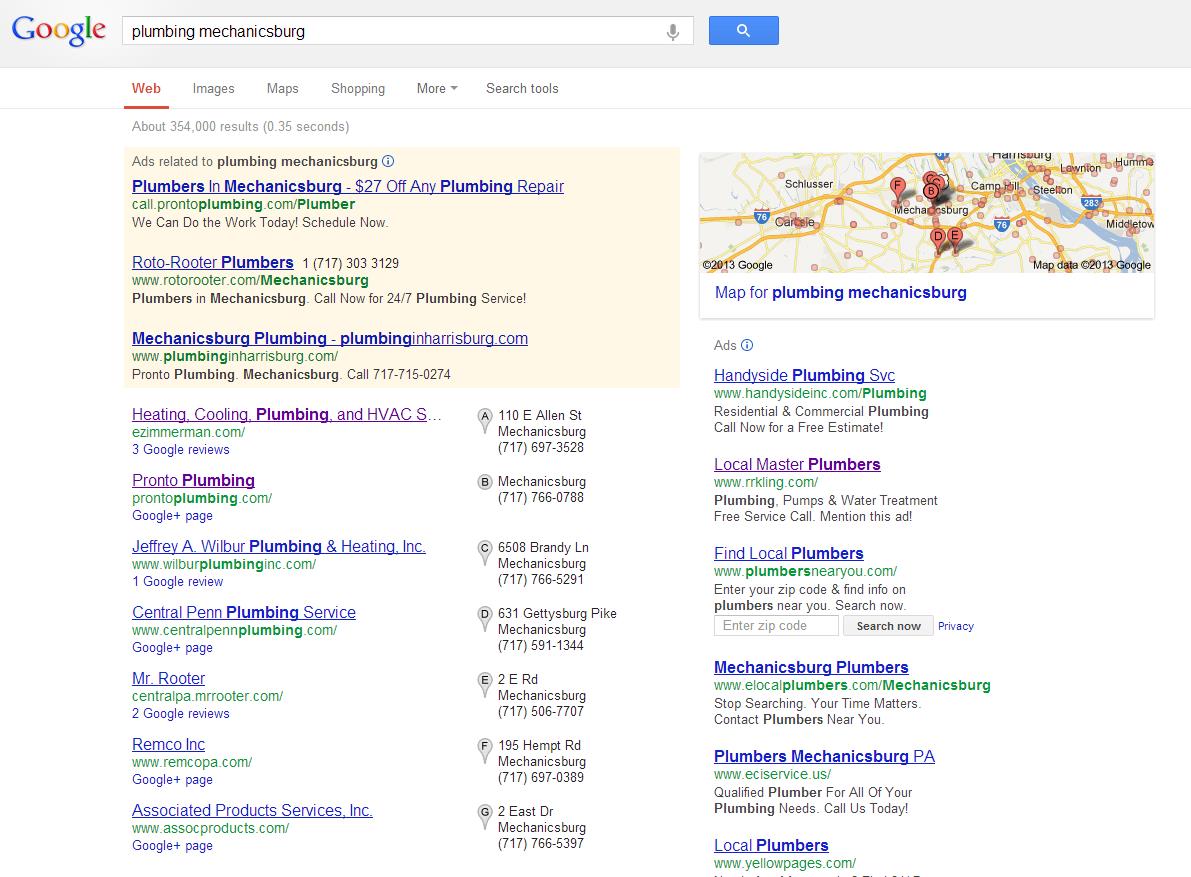

Currently, Starbucks offers customers a 10 cent discount if they bring their own mug. It doesn’t matter what beverage you decide to order, if you have your own mug, cup or container, you get ten cents off the total price. Starbucks reveals this information quite vaguely on their website:

Join the movement. Bring a reusable travel mug and get a 10 cent discount on any Starbucks beverage, anytime.

One person can save trees, together we can save forests

While this is a great plan, the company could actually see a greater effect if they flip-flopped the idea.

Make Customers Work Harder to Avoid Loss

It would make more sense for Starbucks to charge ten cents extra for all of the customers who do not have their own mug or cup. That doesn’t mean they need to raise their prices ten cents, but they simply need to discuss the idea differently.

For instance, let’s say the normal list price of a coffee is $1.70. Customers that bring their own mug or cup are instead charged $1.60. So what if they changed the list price of the drink to 1.60 instead? For everyone else that doesn’t bring their own cup, Starbucks could charge the normal price of $1.70, or ten cents extra.

In other words, they wouldn’t really be changing any of their prices — they would simply be changing how customers look at them. Customers are more apt to avoid a loss and supply their own cups if they know they’re paying extra for a new one each time.

Of course, there are always buyers who don’t want to bother carrying around their own mug but that’s exactly why that extra charge exists – they don’t have to if they don’t want to.

Will This Will Work?

While Starbucks is struggling with their cup problem, this behavioral economics idea is already being used. In Prince George County Maryland, residents are being charged a tax when they use plastic grocery bags. This has encouraged customers to bring their own bags to avoid paying the associated fees.

Originally, customers were offered a five cent bonus for bringing their own reusable bags. However, the campaign didn’t perform as well as the district had hoped. Naturally, they flipped the idea and now impose a five cent tax on customers who ask for grocery bags. Needless to say, people don’t want to pay the tax, leading to a major reduction in the use of grocery bags in the district.

This all boils down to the concept of loss aversion in behavioral economics. The way people look at the cost, or the subjective value, is much greater when it’s coming out of their own pocket.

With the Starbucks example, the original plan makes customers feel like they are earning ten cents instead of losing it. With the flip-flopped example, it actually appears as if the ten cents are coming out of their pocket – resembling a loss. This encourages customers to avoid the loss even if it’s on an even keel with the original model.

How to Make This Concept Work for You

Personal bias and the way things appear equally affect decisions that your customers and employees are making. After all, there’s a valid reason that professional golfers perform much better when trying to save par as opposed to making a birdie.

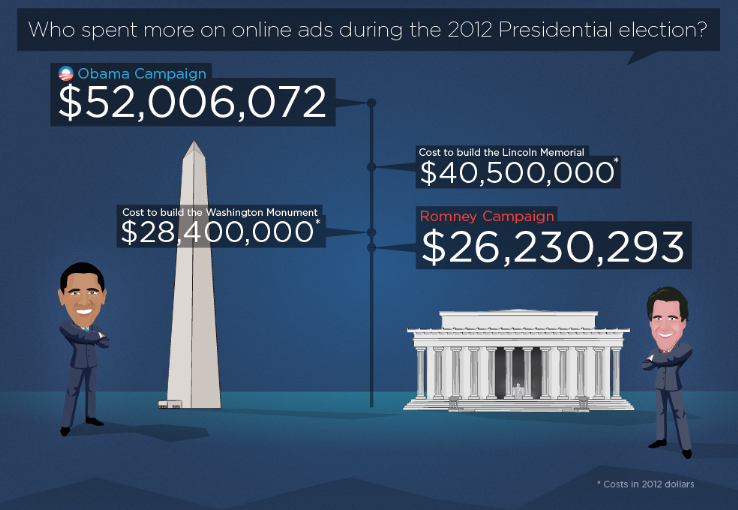

The concept can directly influence investment behavior, advertising, marketing strategies, education campaigns, and much more. Most successful companies employ the use of loss aversion, even if they don’t refer to the concept as that exactly.

Try to remember that people tend to do anything to avoid a loss, and it goes both ways. From a business standpoint, that means you may be less likely to dump a risky investment, because it would mean admitting a loss. Look at each situation objectively, and decide the more beneficial route. When it comes to customers, use it to your advantage. Offer sales items and coupons that help frame purchases as risk averse items. Memolink’s cashback promos frame sale items not with a monetary value, but actually with points therefore taking any attention from the consumer away from a loss of money but more as an accumulation of points. This gamified strategy is very effective in making something risk averse customers try to avoid, into something they feel they are benefiting from…winning points.

In the case of Starbucks, the company is too worried about how customers might react if they change policy. Jim Hanna, environmental impact for Starbucks said “it comes down to the relationship that we’ve built with our customers over the past 40 years.” They don’t want to risk irritating customers who would have to pay the extra ten cents for a cup.

In other words, Starbucks seems to be more worried about the loss than the gains they could experience. As a result, it’s making them avoid the risk altogether. Avoid falling into the same trap yourself, at all costs.